Employee contributes 9 of their monthly salary. The current EPF interest rate for the Financial Year 2021-22 is 810.

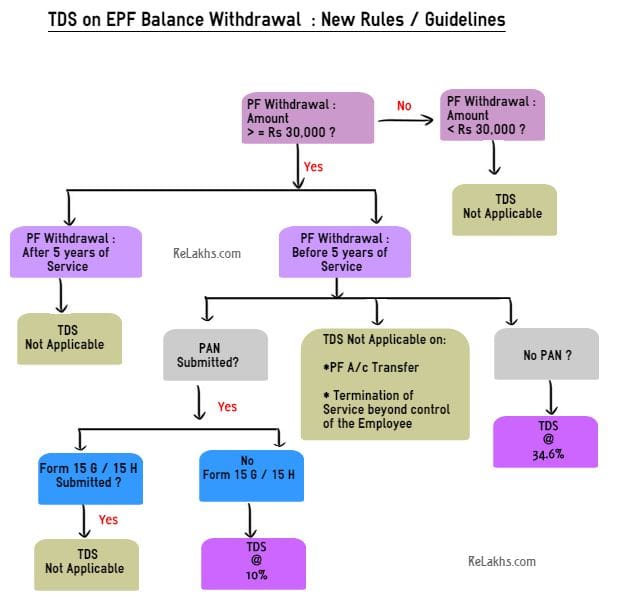

Epf Withdrawals New Rules Provisions Related To Tds

The rate of monthly contributions specified in this Part shall apply to the following.

. The employers make a. For sick units or establishments with less than 20 employees the rate is 10 as per Employees Provident Fund Organisations EPFO guidelines. Employer Employee Contribution RM RM RM RM RM From 001 to 1000 NIL NIL NIL From 1001 to 2000 300 200 500 From 2001 to 4000 600 400 1000 From 4001 to 6000 800 600 1400.

However new Indian Budget for 2015 was released bringing relief to some. The latest contribution rate for employees and employers effective January 2019 salarywage can be referred in theThird Schedule EPF Act 1991. Wages up to RM30.

Rate of contribution for Employees Social Security Act 1969 Act 4 No Actual monthly wage of the month First Category Employment Injury Scheme and Invalidity Scheme. CPF Contribution Rate From 1 January 2015 Table for Singapore Citizens or Singapore Permanent Residents 3rd Year Onwards Employees Age Years Employee. Besides the EPF employers had to contribute 833 on the pension for every individual employee.

HRD32015TransferPolicy616 dated 30052022. In other words the new interest rate announced will be valid from 1st April of one year to the year ending on 31st March of next year. Employee provident fund AC 1 12.

Central Bank 671 621 81 EPF Section. Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit HO No. Even if PF is calculated at higher amount For EPS we will take 15000 limit only.

The interest rate is decided after discussion between the Central Board of Trustees of EPFO and the Ministry of Finance at the end of every financial year. During this period your employers EPF contribution will remain 12. The EPF contribution rate for the financial year 2021 is 85.

EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A. Total Operating Expenditure EPF Dept. The CPF contribution rates for employees earning monthly wages of.

Given below is a list of interest rates of some of the previous years-. Given below is a list of interest rates of some of the previous years-. 9 of their monthly salary.

RATE OF MONTHLY CONTRIBUTIONS PART A 1. To determine CPF allocation in terms of ratio of contribution for all employees. Recently an update regarding the hike in Employees Provident Fund interest rates to 865 has been rolled out by the Labour Minister Santosh.

The financial statements as required under 51i of the Employees Provident Fund Act were submitted to Hon. For Non-Malaysians registered as members from 1 August 1998 section B of EPF Contribution Table. Employees aged 60 and above.

EPF keep Malaysia employees salary percentage which familiar known as 11 some 7 with the new laws and regulations while employers contribute 13 of the employee salary. The interest rate is decided after discussion between the Central Board of Trustees of EPFO and the Ministry of Finance at the end of every financial year. Contributions towards EPF accounts are done by the employee and the employers as well.

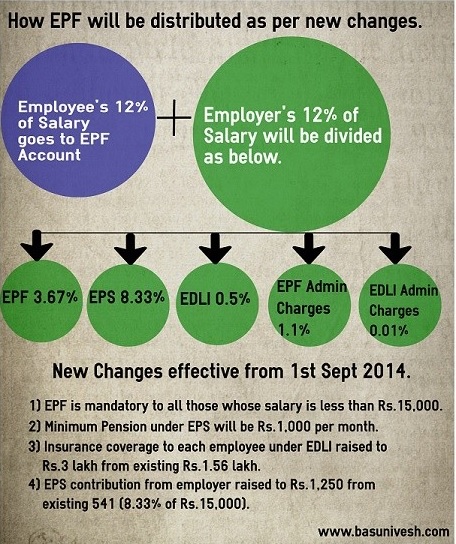

Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. Hike in EPF Interest Rates 2018-19. The employer deposits the amount into the EPF account of employees directly on a monthly basis.

The retirement fund body had in March decided to pay an 81 per cent rate of interest on the provident fund deposits for the. Minister of Finance and HonMinister of Labour and Trade Union Relations. When wages exceed RM30 but not exceed RM50.

Both of the amount of 11 from the employee and 13 from the employer add up together and store 70 into personal EPF account 1 while another 30 store into personal EPF. Employer Employee Contribution RM RM RM RM RM From 6001 to 8000 1100 900 2000 From 8001 to 10000 1300 1100 2400. Employees Pension Scheme 1995 replacing the Employees Family Pension Scheme 1971 EPS Table below gives the rates of contribution of EPF EPS EDLI Admin charges in India.

It was 880 in 2015-16. Employers are required to remit EPF contributions based on this schedule. In Many Companies Employee and Employer are Paying PF on higher amount of 20000.

WSU612019Income TaxPart-I E-333064581 dated 06042022. Earlier the EPF functioned based on contributing 12 of their monthly salary towards EPF while the employer too had to make the same contribution every month. Moreover the interest is calculated monthly but transferred to the Employee Provident Fund account only on 31st March of the applicable.

EMPLOYEES PROVIDENT FUND ACT 1991. Can an employee opt out from the Schemes under EPF Act. 2 days agoThe decision will impact about five crore subscribers of the Employees Provident Fund Organisation EPFO.

Following the Budget 2021 announcement employees EPF contribution rate for all employees under 60 years old is reduced from 11 to 9 by default from February 2021 contribution to January 2022 contribution. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550.

Performance Highlights - 2015 Item 2015 2014Change Total Gross Income Less. The EPF contribution rate for the financial year 2021 is 85. Employer contributes 12 of the employees salary.

At present all employees are required to pay 12 per cent of basic wages including basic salary and DA as contribution to the PF. The employer must pay their employees contributions on or before the 15th of the following wage. Grant of Dearness Allowance to Central Government employees - Revised Rates effective from 01-01.

Epf A C Interest Calculation Components Example

Employee Epf Contribution Rate Reduced Form 12 To 10 Workforce Blog

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Pf Contribution Rate From Salary Explained

Epf Interest Rate From 1952 And Epfo

Tax On Epf Withdrawal New Tds Rule Flowchart Planmoneytax

How Epf Employees Provident Fund Interest Is Calculated

Download Kwsp Rate 2020 Table Background Kwspblogs

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

20 Kwsp 7 Contribution Rate Png Kwspblogs

Confluence Mobile Community Wiki

Employee Epf Contribution Rate Reduced Form 12 To 10 Workforce Blog

Epf A C Interest Calculation Components Example

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

Epf A C Interest Calculation Components Example

Epf Contribution Rates 1952 2009 Download Table

How Will The Reduced Epf Contribution Affect Malaysians Citizens Journal Malaysia

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Epf Interest Rate From 1952 And Epfo